kansas automobile sales tax calculator

Web The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Web Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

Car Tax By State Usa Manual Car Sales Tax Calculator

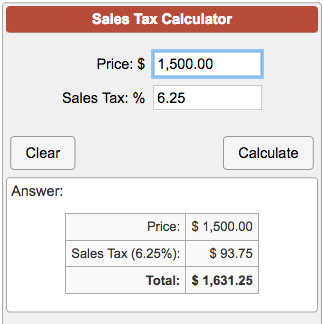

Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information.

. Parsons is located within Labette County Kansas. 775 for vehicle over 50000. Web Kansas State Sales Tax.

Search for Vehicles by VIN -Or- Make Model Year -Or- RV Empty Weight Year. The sales tax in Sedgwick County is 75 percent InterestPayment Calculator. The sales tax varies greatly by location in Kansas with the.

The county the vehicle is registered in. Average Local State Sales Tax. Web Kansas Department of Revenues Division of Vehicles launched KnowTo Drive Online a web-based version of its drivers testing exam powered by Intellectual Technology Inc.

The information you may need to enter into the tax and tag calculators may include. First Letter of Last Name. Vehicle property tax is due annually.

When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. If you make 70000 a year living in the region of Kansas USA you will be taxed 12078. In addition to taxes car purchases in Kansas may be subject to other fees like registration title and plate fees.

You can find these fees further down on the page. The sales tax rate does not vary based on zip code. How to Calculate Kansas Sales Tax on a Car.

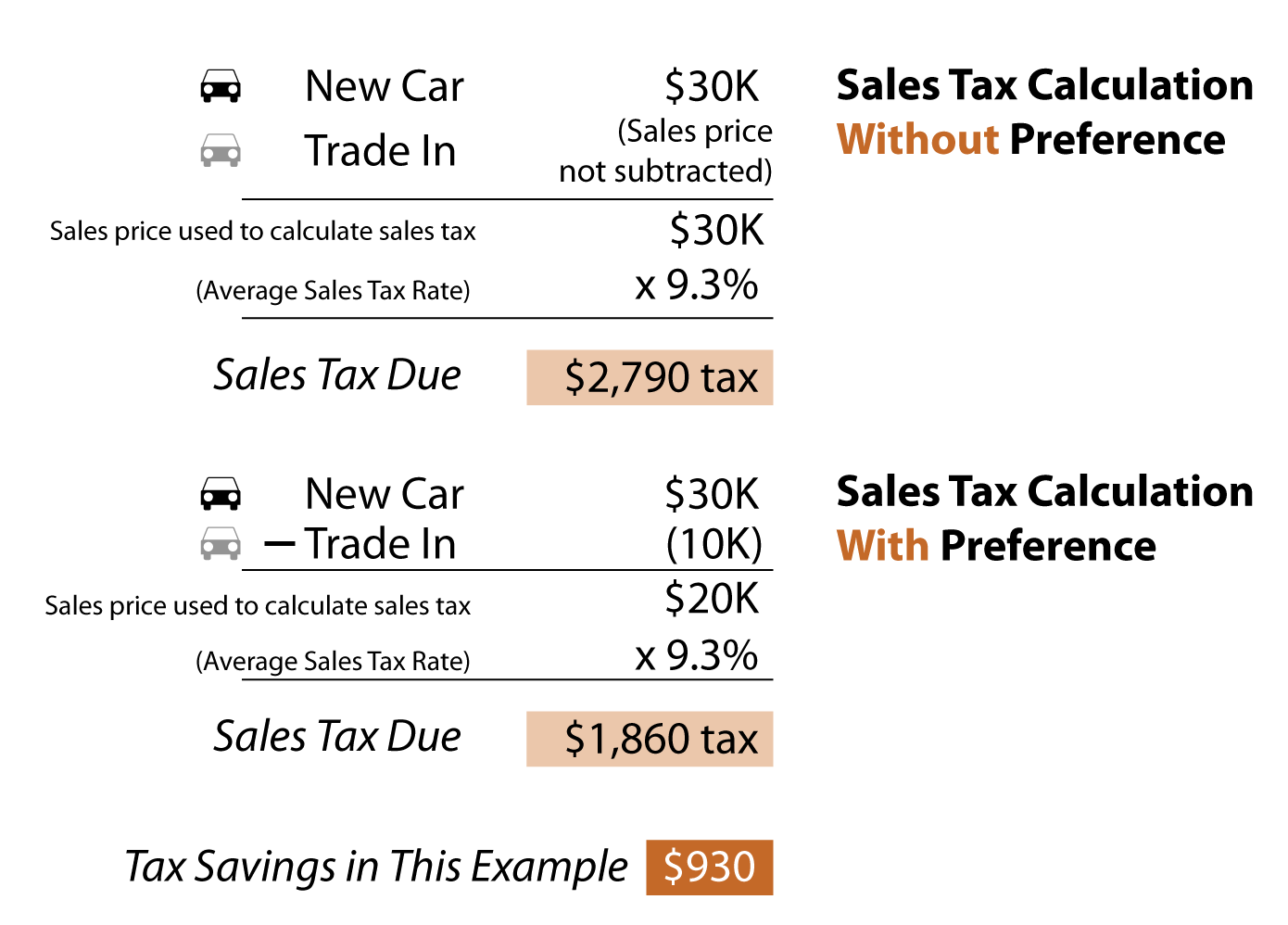

Web Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. You pay tax on the sale price of the unit less any trade-in or rebate. You can find these fees further down on the page.

Web To calculate sales tax visit Kansas Department of Revenue Sales Tax Calculator. 425 Motor Vehicle Document Fee. Web How to Calculate Kansas Sales Tax on a Car.

The type of license plates requested. Price of Car Sales Tax. New car sales tax OR used car sales tax.

Subtract these values if any from the sale. Maximum Possible Sales Tax. The average cumulative sales tax rate in Parsons Kansas is 925.

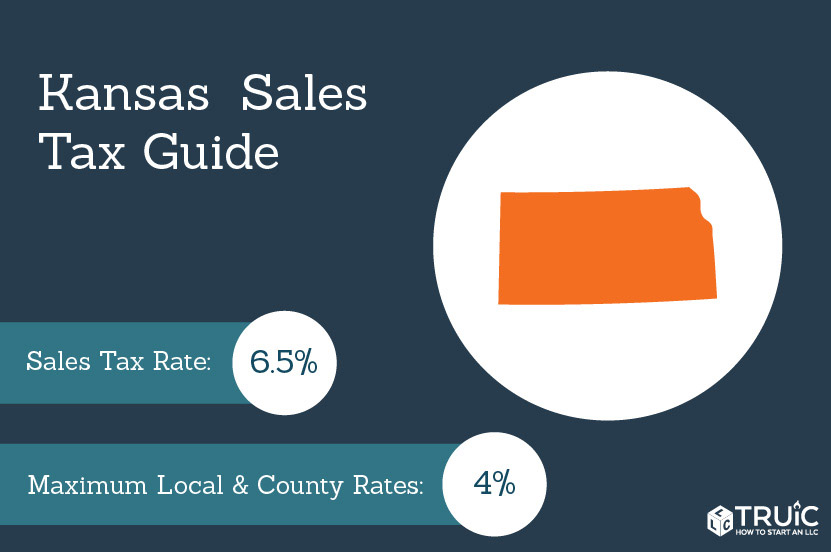

This includes the rates on the state county city and special levels. Whether or not you have a trade-in. County and local taxes can accrue an additional maximum of 4 in sales tax depending on where you buy your car.

You cannot register renew or title your vehicle s at the Treasurers office located in the. You pay property tax when you initially title and register a vehicle and each year when you renew your vehicle tags and registration. Kansas has a 65 statewide sales tax rate but also has 529 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1987 on top.

Web The sales tax rate on vehicles in Kansas is 73 to 8775 or 75 on average. Maximum Local Sales Tax. Use the Kansas Department of Revenue Vehicle Property Tax Calculator to estimate vehicle property tax by makemodelyear VIN or RV weightyear for a partial or full registration year.

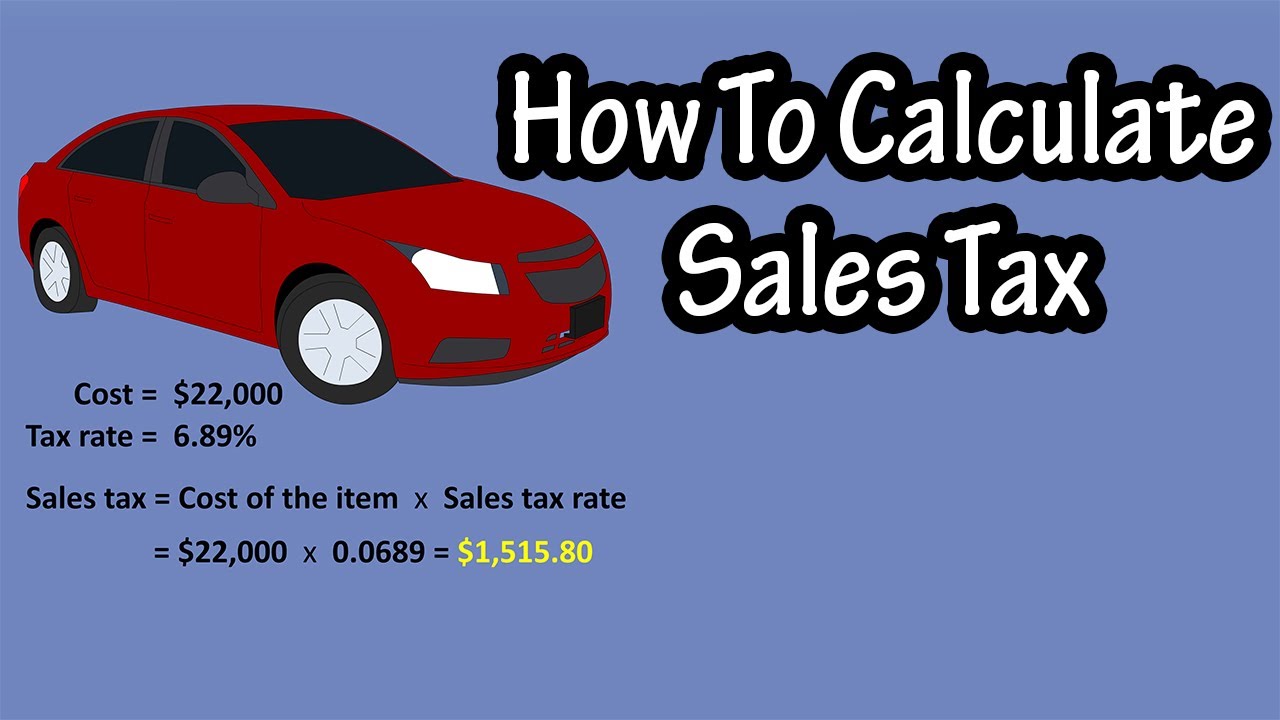

Car tax as listed. Web Kansas Income Tax Calculator 2021. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

Web How to Calculate Kansas Sales Tax on a Car. What you need to know about titling and tagging your vehicle. Multiply the vehicle price after trade-ins andor incentives by the sales tax fee.

The state in which you live. Just enter the five-digit zip code of the location in which. Average Local State Sales Tax.

In this example multiply 38000 by 065 to get 2470 which makes the total purchase price. Multiply the vehicle price after trade-ins andor incentives by the sales tax fee. Web Kansas Vehicle Property Tax Check - Estimates Only.

If you have any questions about how. Web Tax and Tags Calculator. The Kansas average for combined state and local sales tax is currently 8479.

For Kentucky it will always be at 6. The state sales tax rate in kansas is 650. Web For your property tax amount use our Motor Vehicle Property Tax Estimator or call 316 660-9000.

Within Parsons there is 1 zip code with the most populous zip code being 67357. The minimum is 65. Web If you have any questions about how Kansas sales and use tax laws apply to your business please visit the departments Policy Information Library on our web site wwwksrevenuegov or call the departments Taxpayer Assistance Center at 1-785-368-8222.

Web Use this online tool from the Kansas Department of Revenue to help calculate the amount of property tax you will owe on your vehicle. There are also local taxes up to 1 which will vary depending on region. With KnowTo Drive Online Kansans have the opportunity to.

635 for vehicle 50k or less. Your average tax rate is 1198 and your marginal tax rate is 22. The introduction of this testing service adds to the Departments expanding online services it provides.

Motor Vehicle Fees And Payment Options Johnson County Kansas

Calculate Auto Registration Fees And Property Taxes Geary County Ks

Calculate Sales Tax On Car Outlet 60 Off Www Ingeniovirtual Com

What S The Car Sales Tax In Each State Find The Best Car Price

Car Tax By State Usa Manual Car Sales Tax Calculator

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Kansas Sales Tax Small Business Guide Truic

Sales Tax On Cars And Vehicles In Kansas

Calculate Sales Tax On Car Outlet 60 Off Www Ingeniovirtual Com

Calculate Sales Tax On Car Deals 53 Off Www Ingeniovirtual Com

Auto Loan Calculator With Tax Calculate By State With Trade

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

Kansas Vehicle Sales Tax Fees Find The Best Car Price

Missouri Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Dmv Fees By State Usa Manual Car Registration Calculator

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price